By: Editorial Staff, Date: August 22nd, 2022

Sales tax is undoubtedly complex right? But, tax complexities shouldn’t impede the growth of your business!

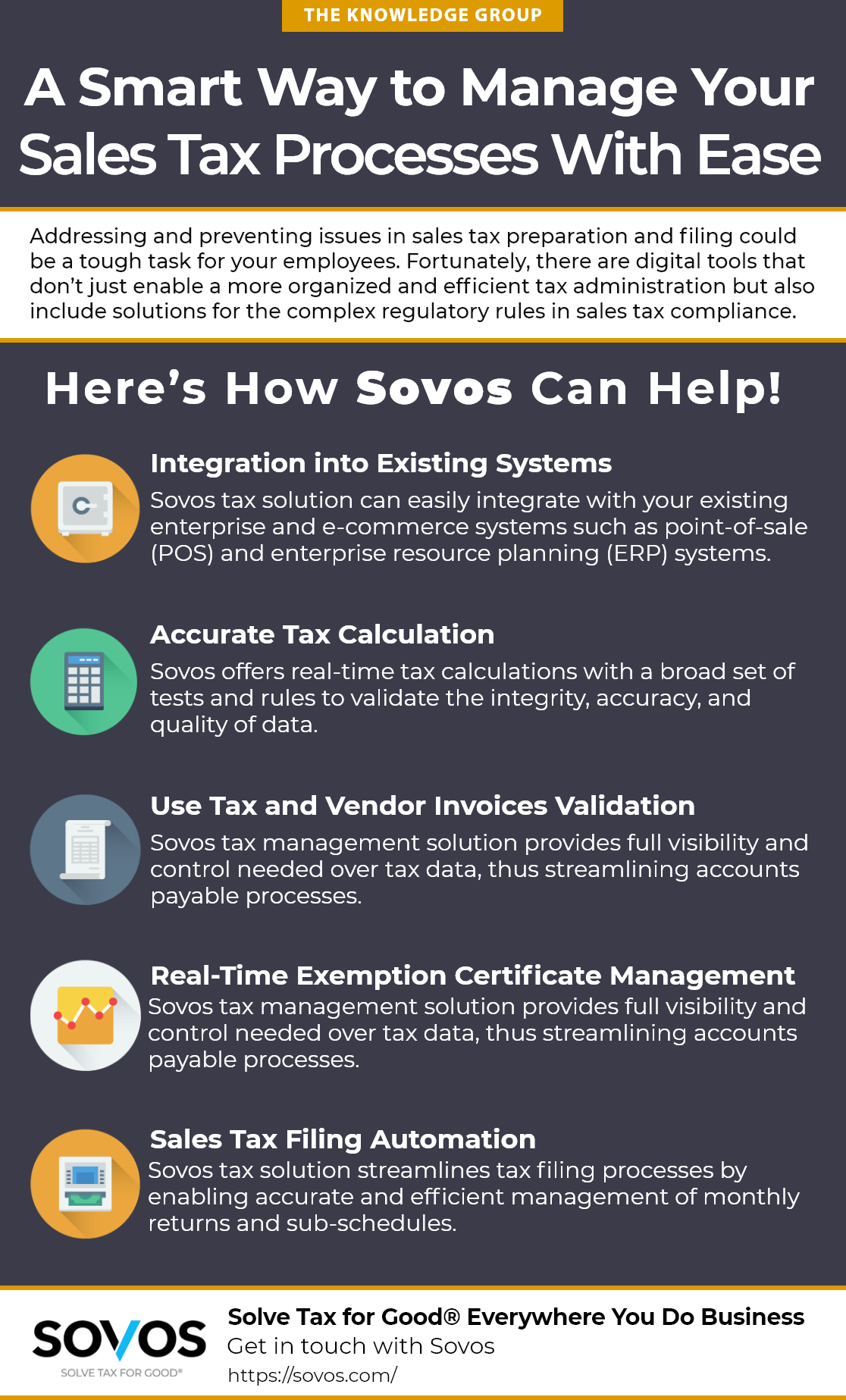

Get started on managing your sales tax processes with ease! Check out the infographic below.

Join our webcast Sales Tax Compliance Technology Trends: Keeping up with the Challenges of Sales Tax Reporting

Solve tax for Good® Everywhere You Do Business, get in touch with Sovos

Upcoming Webcasts

Guiding Success with Ethical Integrity: Accounting’s Professional Standards

In today's dynamic business environment, maintaining ethical integrity is paramount, especially in the field of accounting where professional standards play a crucial role. In this CLE webcast, a panel of thought leaders organized by The Knowledge Group will provide an in-depth discussion about the complexities of navigating professional standards in accounting. Speakers will explore the significance of ethical integrity in accounting practices and offer insights into adhering to professional standards.