By: Editorial Staff, Date: April 4th, 2023

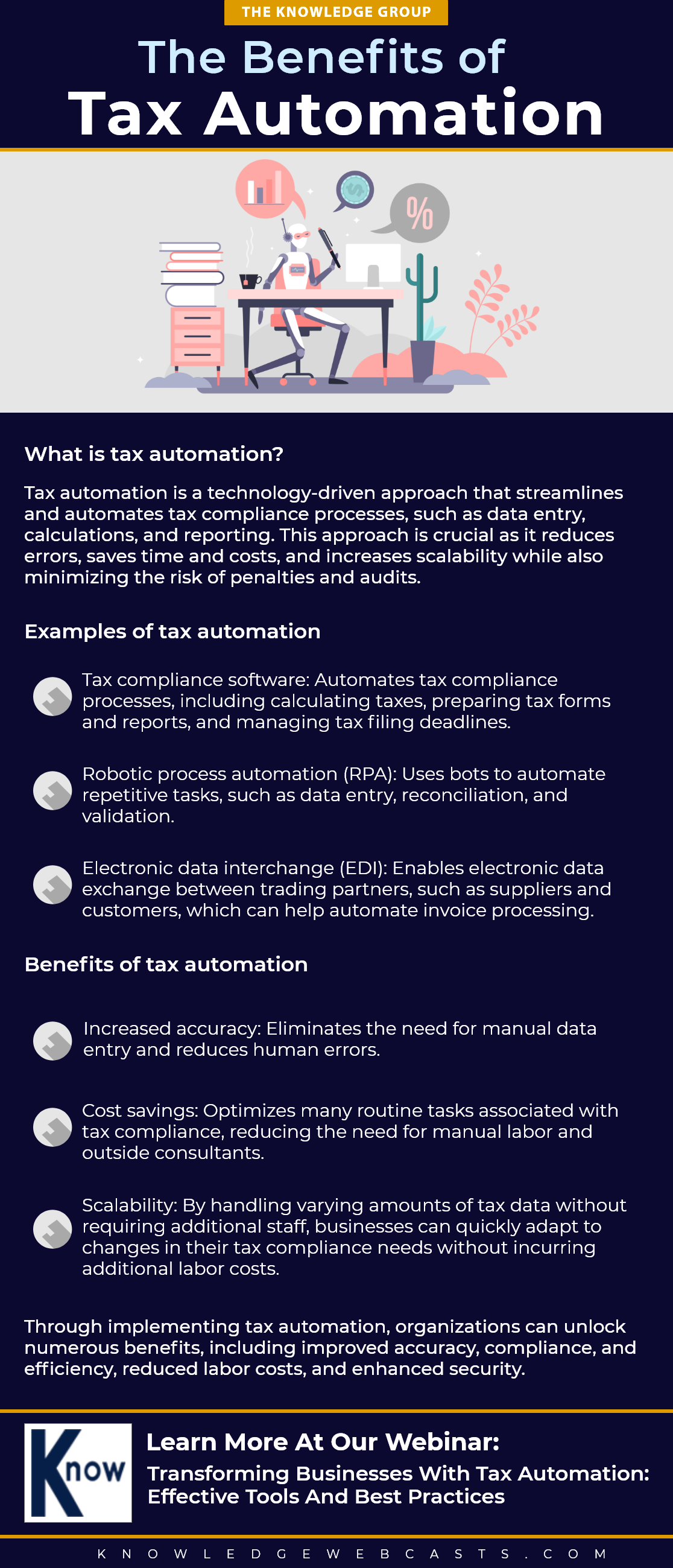

In this infographic, we will delve into the various benefits of tax automation, including increased accuracy, reduced costs, and scalability!

Check out The Knowledge Group’s webinar “Transforming Businesses with Tax Automation: Effective Tools and Best Practices,”

Want to solve tax for good? Get in touch with Sovos

Upcoming Webcasts

lazupardo2024-09-16T17:57:56-04:00

Maximizing Your Innovation ROI: R&D Tax Credits in 2024 and Beyond

Innovation is the driving force behind business growth and success, and Research and Development (R&D) serves as the catalyst for innovation. As we venture into the dynamic landscape of 2024 and beyond, maintaining a competitive edge requires more than just visionary ideas; it demands strategic financial acumen.